Arturo Perera describes GBS Finance´s business philosophy in an interview in elAsesorFinanciero.com

The commercial director of GBS Finance Wealth Management, Arturo Perera, details in an interview in elAsesorFinanciero.com the business philosophy of the company, based on the proximity to families, and highlights the offer of 360º services, advising its customers on each and every one of the needs they face in their daily lives. He also explained the changes that the application of MiFID II would entail, a rule that, in his opinion, represents a major step forward in terms of transparency in management.

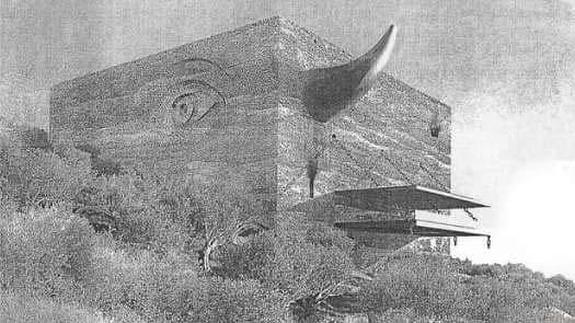

The City Council of Ronda finally approves the GBS Finance project La Almazara, designed by Philippe Starck

La Almazara, the GBS Finance Investments project designed by the prestigious architect Philippe Starck, received on Monday July 30th the final approval of the Plenary Session of the City Council of Ronda. Last June, the mayor of Ronda, Teresa Valdenebro, and the municipal delegate for Works and Urban Planning, Francisco Márquez, announced that the project had already received all the favorable reports from the Regional Ministry for Regional Planning of the Government of Andalusia.

Daniel Galván explains the latest trends in the retail sector

The director of GBS Finance, Daniel Galván, explains that the retail sector is evolving along the lines of “having fewer stores but in prime areas” in a report on the changes that El Corte Inglés is experiencing published by Voz Pópuli. Galvan adds that “several US distribution giants are testing very well located small shops, even without offering physical products, in order to position themselves in online commerce.”

Alberto Roldán warns against excessive portfolio diversification

GBS Finance Wealth Management’s Investment Manager, Alberto Roldán, considers that the excessive diversification of portfolios is a “very inefficient strategy because, in addition to bearing an unnecessary cost, it prevents the best bets from shining in the aggregate profitability” in an interview published by Funds&Markets, of the Dirigentes group.

GBS Finance Investments project, La Almazara, receives favorable reports from the Junta de Andalucía

La Almazara, GBS Finance Investments project, designed by the prestigious architect Philippe Starck, already has all the favorable reports of the Ministry of Planning of the Junta de Andalucía, as announced by the mayor of Ronda, Teresa Valdenebro, and the municipal delegate of Works and Urbanism, Francisco Márquez. The project could be debated, to obtain its final approval, in the next plenary session to be held on the last Monday of July.

Broad media coverage of GBS Finance’s advice to Orient Hontai Capital on the acquisition of 53.5% of Imagina

The closing of the agreement on June 26th between Imagina Audiovisual Media and Orient Hontai Capital (OHC) for the acquisition by the latter of 53.5% of Imagina has had wide media coverage. GBS Finance and Deutsche Bank have acted as financial advisors to Orient Hontai.

GBS Finance advises Orient Hontai Capital in a €1900M acquisition of 53,5% of Imagina.

On Tuesday, June 26, the agreement between Imagina Media Audiovisual and Orient Hontai Capital (OHC) on the acquisition of 53,5% de Imagina was closed, after obtaining all the regulatory and administrative authorizations. The shareholding Group is made up by Orient Hontai (53,5%), WPP (22,5%), and two of the Group’s founding members, Tatxo Benet (12%) […]

Interview with GBS Finance partner Pablo Gómez de Pablos in ‘Consejeros’

GBS Finance partner Pablo Gómez de Pablos analyses the situation of the Spanish stock market and economy in an interview published by the magazine `Consejeros’, in which he says that you can make good transactions at reasonable prices, “but you have to look for them”.

The director of GBS Finance in Valencia analyzes the collapse of the Stock Exchange

Javier Navarro, director of GBS Finance in Valencia, analyzes the collapse of the Stock Exchange in Valencia Plaza. Navarro believes that “we are living an escape to lower risk assets as a result of the coincidence in time of the increase in political uncertainty and populisms in Italy and Spain.” He also believes that “the expansive cycle has lost some vigor but is still valid”.

When is it important to have a global picture of your heritage?

Keys for the good management of your patrimony, monitoring and consolidation of positions with the correct choice of holders. The figure of the depositary is fundamental. The offer is huge and it is important to leave to the professionals the choice of who should guard your heritage.